It is a new method of investing in finance. The exchange is based upon a peer-to-peer principle that allows users to trade bets on sports with other users. The exchange functions in the same manner as the stock markets. Most exchanges make money by charging small commissions on winning bets. This is a more profitable way than betting on a traditional bookmaker.

The market is very competitive. The prices can be requested by users. The crown consensus is simply the number people who wish to place a wager on an upcoming event. Some punters even go as far to create their own betting market. A good example of this is Betfair, which was founded by a bettor and a professional trader.

A bet placed on an exchange is more intuitive than a bet placed at a traditional betting site. A bettor at an exchange may place bets on the Super Bowl winning. This is a very logical feat, considering it's not something you can wager on at a traditional betting site. A bettor on an Exchange can also close down losing bets early if he feels the team is going bust.

A betting exchange is quicker than traditional bookmakers. A bookmaker may reduce the cost of a bet by reducing it from seven to four. An exchange bettor might see a twelve-tick move. But, an exchange bet is not a guarantee of a payout. Before placing a stake, read and understand the terms and condition of your provider. You should also ensure that you have enough cash on hand to cover the cost of placing a stake.

You will get the best exchange experience if you choose a site with a large user base, and a strong security infrastructure. You should have a wide range of payment options, such as credit cards, PayPal and e-wallets like Skrill or ClickandBuy. Typically, the best exchanges will offer a 5% commission to high volume bettors.

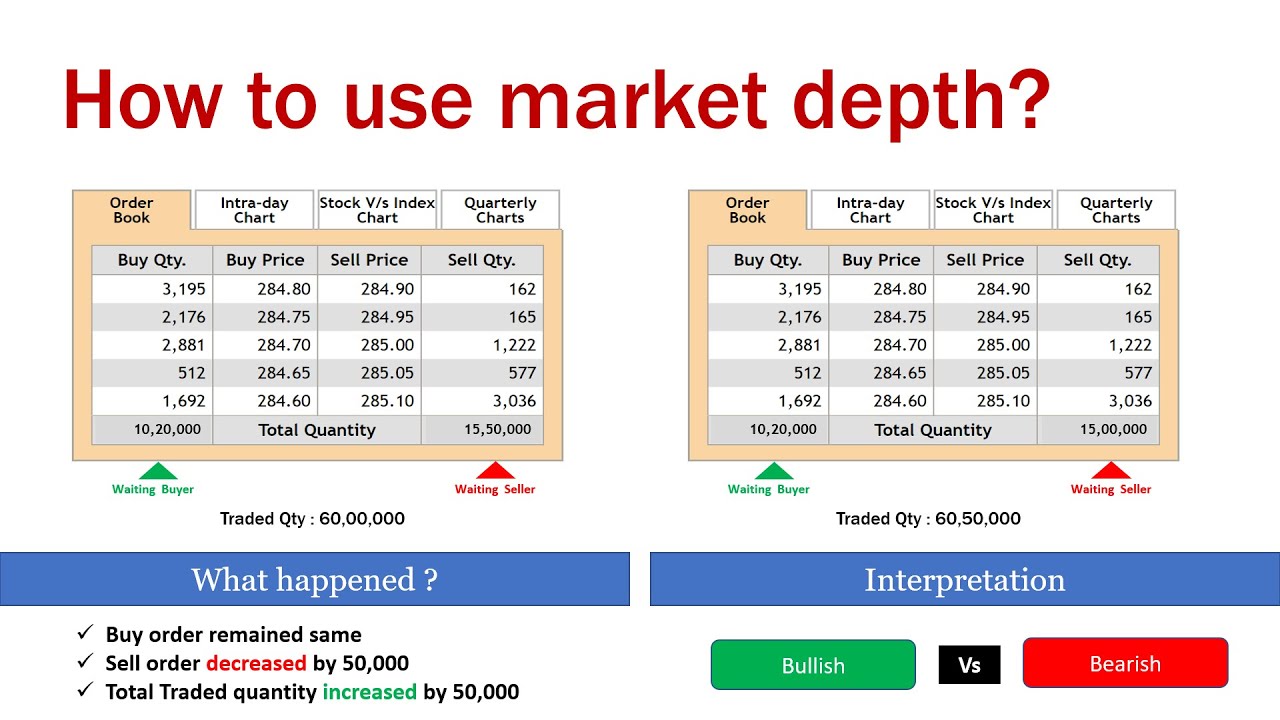

It is common for the top exchanges to offer free bonuses or promotions for their regular users. The Market Depth is an indicator of how much money is available to match bets. There is so much to learn about these exchanges that it is important to do your research before signing up.

Trading positions via a betting exchange can be a hassle, but it is more likely to provide higher returns than traditional bookmakers. You can also find a site that offers betting on the same sports events as you are interested in.

The best exchanges offer the best bonuses and promotions, so it's worth signing up. It is possible to lose some money on an exchange but it is much more common to lose your money when you play at a traditional sportsbook.

FAQ

What is the difference between passive and active income?

Passive income means that you can make money with little effort. Active income requires hard work and effort.

Active income is when you create value for someone else. You earn money when you offer a product or service that someone needs. Examples include creating a website, selling products online and writing an ebook.

Passive income is great because you can focus on other important things while still earning money. Most people don't want to work for themselves. Instead, they decide to focus their energy and time on passive income.

The problem is that passive income doesn't last forever. If you wait too long to generate passive income, you might run out of money.

It is possible to burn out if your passive income efforts are too intense. It's better to get started now than later. If you wait to start earning passive income, you might miss out opportunities to maximize the potential of your earnings.

There are three types of passive income streams:

-

Businesses - these include owning a franchise, starting a blog, becoming a freelancer, and renting out the property such as real estate

-

Investments - These include stocks, bonds and mutual funds as well ETFs.

-

Real Estate - this includes rental properties, flipping houses, buying land, and investing in commercial real estate

What is the easiest way to make passive income?

There are many options for making money online. Many of these methods require more work and time than you might be able to spare. How do you find a way to earn more money?

The answer is to find something you love, whether blogging, writing, designing, selling, marketing, etc. and monetize that passion.

For example, let's say you enjoy creating blog posts. Create a blog to share useful information on niche-related topics. When readers click on those links, sign them up to your email list or follow you on social networks.

Affiliate marketing is a term that can be used to describe it. There are many resources available to help you get started. Here are some examples of 101 affiliate marketing tools, tips & resources.

You could also consider starting a blog as another form of passive income. You'll need to choose a topic that you are passionate about teaching. However, once you've established your site, you can monetize it by offering courses, ebooks, videos, and more.

There are many ways to make money online, but the best ones are usually the simplest. Focus on creating websites or blogs that offer valuable information if you want to make money in the online world.

Once you've created your website promote it through social media like Facebook, Twitter LinkedIn, Pinterest Instagram, YouTube, and many other sites. This is called content marketing, and it's a great method to drive traffic to your website.

What is the limit of debt?

It is essential to remember that money is not unlimited. You'll eventually run out cash if you spend more money than you earn. It takes time for savings growth to take place. You should cut back on spending if you feel you have run out of cash.

But how much should you live with? There isn't an exact number that applies to everyone, but the general rule is that you should aim to live within 10% of your income. You won't run out of money even after years spent saving.

This means that, if you have $10,000 in a year, you shouldn’t spend more monthly than $1,000. You shouldn't spend more that $2,000 monthly if your income is $20,000 You shouldn't spend more that $5,000 per month if your monthly income is $50,000

It's important to pay off any debts as soon and as quickly as you can. This includes credit card bills, student loans, car payments, etc. You'll be able to save more money once these are paid off.

It would be best if you also considered whether or not you want to invest any of your surplus income. If you choose to invest your money in bonds or stocks, you may lose it if the stock exchange falls. But if you choose to put it into a savings account, you can expect interest to compound over time.

Consider, for example: $100 per week is a savings goal. That would amount to $500 over five years. Over six years, that would amount to $1,000. In eight years, your savings would be close to $3,000 When you turn ten, you will have almost $13,000 in savings.

At the end of 15 years, you'll have nearly $40,000 in savings. That's quite impressive. You would earn interest if the same amount had been invested in the stock exchange during the same period. Instead of $40,000 you would now have $57,000.

You need to be able to manage your finances well. A poor financial management system can lead to you spending more than you intended.

What is the fastest way to make money on a side hustle?

If you really want to make money fast, you'll have to do more than create a product or service that solves a problem for someone.

You need to be able to make yourself an authority in any niche you choose. That means building a reputation online as well as offline.

Helping others solve their problems is a great way to build a name. Ask yourself how you can be of value to your community.

Once you answer that question you'll be able instantly to pinpoint the areas you're most suitable to address. There are many opportunities to make money online. But they can be very competitive.

If you are careful, there are two main side hustles. The one involves selling direct products and services to customers. While the other involves providing consulting services.

Each approach has its pros and cons. Selling products or services offers instant gratification, as once your product is shipped or your service is delivered, you will receive payment immediately.

The flip side is that you won't be able achieve the level you desire without building relationships and trust with potential clients. These gigs are also highly competitive.

Consulting allows you to grow your business without worrying about shipping products or providing services. However, it can take longer to be recognized as an expert in your area.

To be successful in either field, you must know how to identify the right customers. This can take some trial and error. But it will pay off big in the long term.

Why is personal finance important?

For anyone to be successful in life, financial management is essential. In a world of tight money, we are often faced with difficult decisions about how much to spend.

Why do we delay saving money? Is there anything better to spend our energy and time on?

Both yes and no. Yes, as most people feel guilty about saving their money. No, because the more money you earn, the more opportunities you have to invest.

If you can keep your eyes on what is bigger, you will always be able spend your money wisely.

To become financially successful, you need to learn to control your emotions. When you focus on the negative aspects of your situation, you won't have any positive thoughts to support you.

Unrealistic expectations may also be a factor in how much you will end up with. You don't know how to properly manage your finances.

These skills will prepare you for the next step: budgeting.

Budgeting refers to the practice of setting aside a portion each month for future expenses. Planning will help you avoid unnecessary purchases and make sure you have enough money to pay your bills.

Once you have mastered the art of allocating your resources efficiently, you can look forward towards a brighter financial tomorrow.

How does a rich person make passive income?

There are two ways you can make money online. One is to create great products/services that people love. This is called "earning” money.

You can also find ways to add value to others, without having to spend your time creating products. This is known as "passive income".

Let's say that you own an app business. Your job is developing apps. But instead of selling the apps to users directly, you decide that they should be given away for free. It's a great model, as it doesn't depend on users paying. Instead, you can rely on advertising revenue.

In order to support yourself as you build your company, it may be possible to charge monthly fees.

This is how successful internet entrepreneurs today make their money. They are more focused on providing value than creating stuff.

Statistics

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

External Links

How To

How to Make Money While You Are Asleep

It is essential that you can learn to sleep while you are awake in order to be successful online. This means more than waiting for someone to click on the link or buy your product. Making money at night is essential.

This means you must create an automated system to make money, without even lifting a finger. You must learn the art of automation to do this.

It would be helpful if you could become an expert at creating software systems that automatically perform tasks. This will allow you to focus on your business while you sleep. You can even automate the tasks you do.

The best way to find these opportunities is to put together a list of problems you solve daily. Next, ask yourself if there are any ways you could automate them.

Once that's done, you'll likely discover that you already have many potential passive income sources. Now, you have to figure out which would be most profitable.

You could, for example, create a website builder that automates creating websites if you are webmaster. Maybe you are a webmaster and a graphic designer. You could also create templates that could be used to automate production of logos.

You could also create software programs that allow you to manage multiple clients at once if your business is established. There are hundreds of possibilities.

As long as you can come up with a creative idea that solves a problem, you can automate it. Automation is the key for financial freedom.